this post contains affiliate links

Now is as good as a time as ever to evaluate your spending and see if there are places you can be saving money. Sometimes the topic of finances can seem SO overwhelming. Personally, I like to tackle it by tasks or steps. This makes it feel more achievable and shows your progress.

So, in this post, I’m outlining 12 things you can consider adopting that will save you money. Each one is sort of a “step” that you can cross off a list and see the progress you’re making. And at the bottom, I also shared some additional finance posts that might be helpful.

Minimize Your Wardrobe

When my son was born, I became really overwhelmed with my wardrobe. There was just too much in there. I didn’t have time to make outfits. I wanted to open my closet, grab a shirt I liked, pants I liked, and be done. So, I started the process of creating more of a capsule wardrobe. The idea of a capsule wardrobe is basically that you have minimal items that are classic, good quality, and versatile. I was able to cut my clothing and shoes in half, and haven’t looked back.

The reason this saves money is I’m no longer tempted to buy the cutest and newest. I don’t feel the temptation to “swing by Marshalls” really quick or browse the clothing section at Target. I have my tried-and-true classics I know and love, and I can stick with them. And, when a new season comes around, I know exactly what pieces I’m missing that I need. For example, this winter I realized all I was really missing was sweaters. So, the only clothing I allowed myself to buy was sweaters. It prevented impulse buying, prevented a cluttered closet, and saved me loads of money.

Get Money Back When You Shop

Cash-back sites are the best. If you’ve never used one, it’s really simple. You go to the site you are shopping from through their site and it tracks your purchases. Then, you get a little money back for things you were already going to buy!

Personally, I use TopCashback for a few reasons. First, they give the most payout available so I’m getting the most cash back I can. Second, they have an awesome browser extension that reminds you to activate the cashback when you’re shopping so you never forget. The reason I never used cashback sites before was because I always forgot to do it! This solved that for me. Thirdly, they have all the sites I shop at like Amazon, Target, Old Navy, etc. Lastly, if you’re new they have a signup bonus where you can get a $5 bonus when you spend your first $25.

Use Browser Extensions When You Shop

Just like TopCashback has a browser extension to save you money, there are other great ones out there. Honey is another one of my favorites. It checks the web for coupons that might be available when you’re about to checkout and tries to apply them all. It ensures you’re not missing any deals. It has saved me as much at $60 before!! Honey also offers a point system when you make purchases and you can redeem points for gift cards.

Live Below Your Means

I’ve talked about this before. And, I understand that this isn’t an option for everyone depending at where you are in your life. But you might be surprised, when you really evaluate your finances and lifestyle, what you can do.

If you get to a point where you’ve paid off debt and now have extra cash (even if it’s a little), the goal should be to create a monthly budget that gives you a cushion. A simple example of this is when Michael and I create our monthly budget, we don’t factor my full revenue stream (from blogging and YouTube) into our monthly income. This extra income is…well, extra. We can use it for saving for big purchases (like furniture or vacation) so that we don’t have to use credit cards or creating a financial cushion so when the unexpected comes up we have some money to use.

Essentially, we try to live off one income as much as possible. We’re living below our means this way. So, when we make big financial decisions (like buying a house) we try to do it on a single income. While we could have afforded a house at a higher price point than our house and we were pre-approved for that price, we choose to shop for houses below that so that we continue to have monthly expenses that we can pay using just Michael’s income (or Michael’s income and 1/2 of mine.)

There are a few benefits to living below our means.

- It gives us a financial cushion. It ensures we have enough extra money each month for unexpected things – sort of like what’s going on in the world now.

- Has allowed me to stay home with Miles 3 days a week and only work 2 days a week.

- It gives us wiggle room in our budget if something were to happen to one of our jobs like a layoff or there was a medical emergency. .

Meal Plan

It might sound like I’m exaggerating but meal planning saves me anywhere from 25-50% on my groceries. I can see a CLEAR difference in the receipts when I meal planned versus when I didn’t. The reason it works is because you’re making sure to use up things already in your kitchen, you are making a list and sticking to it (ie. not grabbing extra unneeded items), and you have everything you need for the week which avoids extra unneeded grocery runs.

If you need some meal planning help, check out my post on How I Meal Plan, which includes free meal planning printables.

Try the Envelope Trick

Personally, this hack isn’t one I’ve ever used, but it works really well for a lot of people. The concept is you get an envelope for each line item in your budget and you place the appropriate CASH in each one. For example, if your grocery budget is $100/week then you put $400 in that envelope and that’s ALL you get for the month. The Budget Mom shares a lot about using this trick if you want to see more.

Add to Cart…Then Step Away

This is a trick my husband and I used when we realized Amazon purchases were adding up a little quicker than we preferred. The problem with online shopping is it’s so easy to buy. You can just think of something you need and then BAM… you can buy it.

So, what we started doing was throughout the week if we thought of something we’d need, we’d add it to our cart. Then on Sunday, we’d look at the cart together. Usually just seeing the cart total added up was enough for us to say “yea we don’t need all this.”

We’d take stock of what was in there and decide what was definitely necessary. Yes, we were out of diapers so we needed those, but the 6-pack of frames I had added for a DIY could probably wait and I could check the craft stores for when they were on sale.

This works good for all purchases. If you want new clothing or makeup or whatever…add it to your cart and wait on it a day or two. You might realize you don’t really need it.

Use Grocery Delivery

I’m aware in the current state of the nation, this might not be available. I can’t get groceries delivered where I am right now. But, when things settle a bit you might not believe it, but grocery delivery often saves me money.

Yes I pay anywhere from $3-$9 to have it delivered BUT, I only get exactly what I need and don’t end up with any silly extras I might have gotten when I saw them on display. Plus, it’s super easy to find the best prices when you have some time to browse the app.

Keep a Spending Diary

Just like how a food diary helps people trying to eat better, a spending diary can help keep your money in check. There’s something about the accountability aspect that can help you keep a handle on your spending, make you double think necessary purchases, and keep you from overspending.

Reset Your Spending with a No-Spend Month

Sometimes we all need a reset when we’ve developed bad habits. But just like bad habits can form, you can form new, good ones. I usually find it takes 2-3 weeks to do this. It’s why Whole30 works great for people. It forces healthy eating for 4 weeks. The first 2 weeks are hard, then you solidify the healthy eating.

You can set up a no spend month however you want. Maybe you want it to be a complete no spend and you don’t buy anything but the bare necessities. Maybe you just want to do a no online shopping spend. Or a no takeout/restaurant spend.

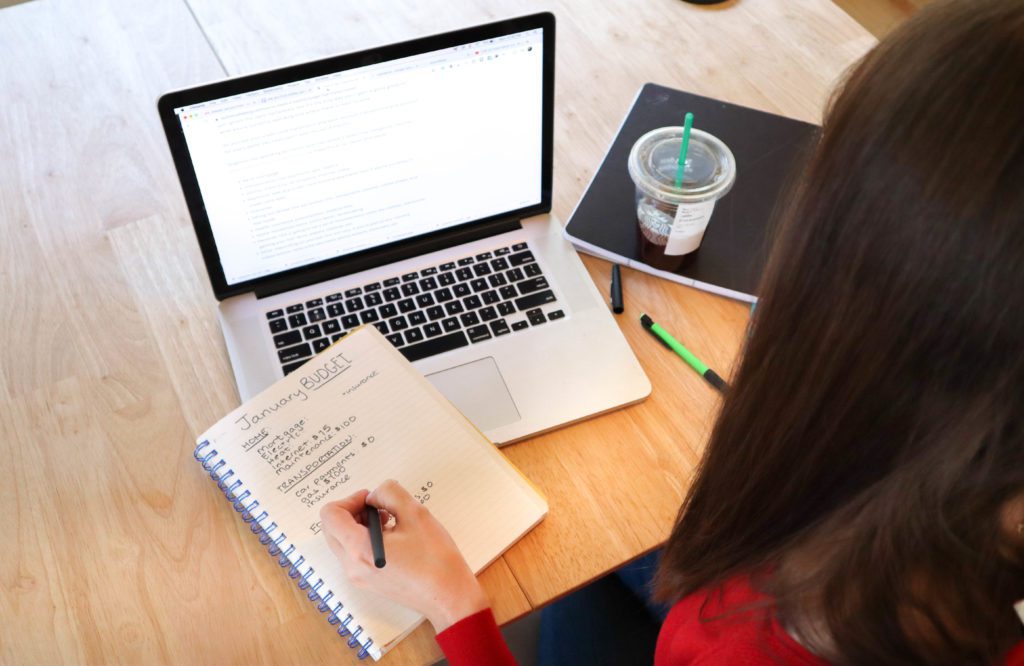

Have a Detailed Budget

Without a budget, you’re just kinda spending on a whim. You don’t really know how much you can afford a month and have no way to ensure extra money each month to allocate towards other goals (such as paying off debt, savings, etc.)

The problem is, making a budget is harder than we think. We think we can just allocate money to a few categories and call it good but it’s much more than that. I have an entire post that goes into depth on this that tells you how to make a SUCCESSFUL budget that will really help.

Shop Used

I feel like this tip is thrown around so often but it’s not ever really embraced for the sheer power it has. Let’s just discuss a few of the benefits:

- Decrease waste. The world of goods has changed so much. Fast fashion, discount furniture, single-use… we buy and throw away a lot more than previous generations. Fashion waste is a growing problem. “More than 60 percent of fabric fibers are now synthetics, derived from fossil fuels, so if and when our clothing ends up in a landfill (about 85 percent of textile waste in the United States goes to landfills or is incinerated), it will not decay.” (New York Times). And, that’s just one example. There are a lot of other things we throw away that we don’t always need to.

- Save Money – I’m amazed how much I can save, especially on baby-related items, when I shop used. I’ve found things I paid full price for in basically new condition for 50% less. It takes a little time (I check my local consignment every 4-10 weeks) but saves me quite a bit of money in the long run.

Other Helpful Posts On Saving Money: